How Does it work?

The revenue principle of GAAP requires revenue to be recorded in the period it is earned regardless of when it is billed or when cash is received. This is a simple measure if you are selling and shipping a product to a customer, but can become an administrative challenge for companies that are delivering high value, lengthy installation projects. A lot of companies we talk to have disconnected accounting and project tools. They are left to reconcile and manage revenue recognition on spreadsheets, which results in huge investments of time to ensure accuracy.

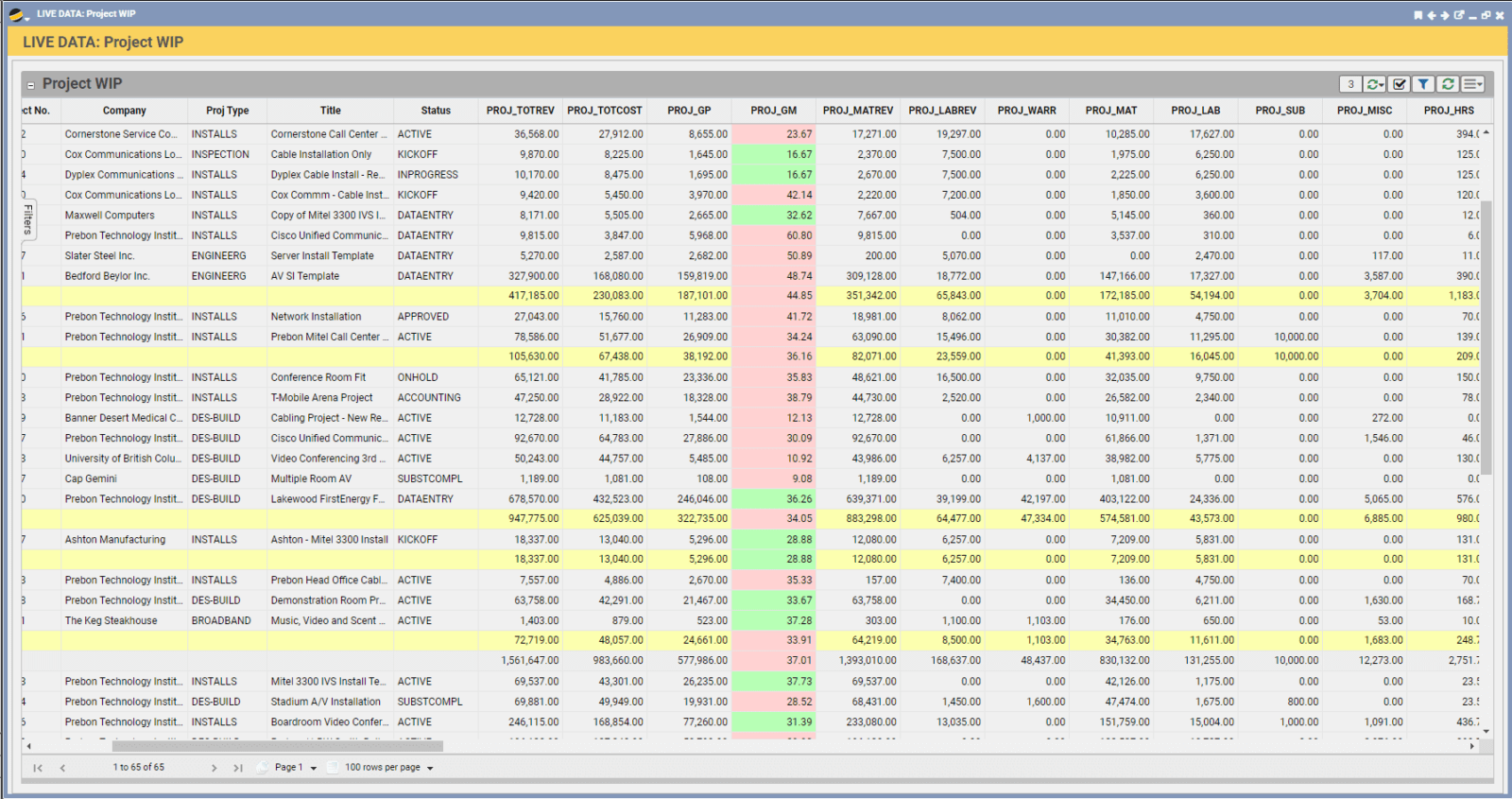

Q360™ automatically tracks the following and keeps them in line, as close to real-time as possible:

- Estimated costs and revenues

- Actual costs and revenues

- Total billings

- Percentage complete

Bottom Line