As many integration firm owners finalize their 2023 budgets, they have to ask themselves:

As many integration firm owners finalize their 2023 budgets, they have to ask themselves:

“Does this budget hold water?”

“Will these assumptions and projections float … or will they sink like a stone?”

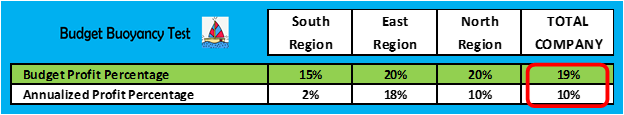

To solve this buoyancy issue, integrators should seriously consider these four questions:

- What is Your Basis for Comparison?

A friend of mine recently sent me her company’s budget to review. The worksheets represented meticulous calculations, logical organization, documented assumptions, and departmental projections, so she was aghast when I told her there was no way for me to coherently evaluate her budgets.

She had only the budgets without any company history or industry comparisons.

Without a basis of comparison, no conclusions could be drawn about the budget’s viability. The key assumptions of revenue, gross profit, and fixed costs must be evaluated in context. Without this context, budgets are just wish-lists and offer little guidance.

Where do we derive context? Annualized, current-year numbers are the place to start.

While we don’t necessarily expect the past to repeat itself, we can judge the budget’s “stretch.” We need to gain a sense of the stretch built into all critical assumptions. Some assumptions should have a degree of stretch built in so we can exceed existing results. Multiple stretch assumptions, however, can be like trying to swim with rocks tied around your neck.

It’s highly unlikely that you can increase revenues, improve margins, and cut fixed cost simultaneously.

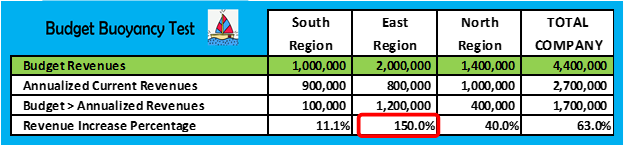

- Is the Revenue Assumption an Easy Swim or a Deadly Struggle?

Are you growing revenue by 10% or 60%?

The first imperative is to determine how much you assume the new budget’s revenue will exceed the current year’s revenues. This is likely the most critical and volatile assumption for your budget to hold water.

If you get this assumption wrong, it usually sinks the validity of the entire budget.

Challenge the sale team’s projection of future revenue. If you annualize the most recent six months or three months of sales, how do they compare to the budget revenue? If that comparison is unfavorable, then you have a sales department wish-list and not a valid projection.

Make sure you have a reachable objective and not a deadly swim.

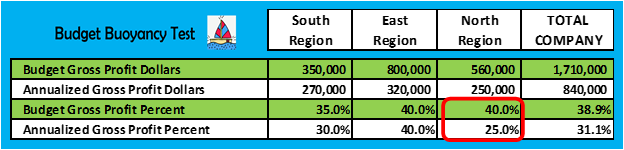

- Will the Gross Profit Assumption Tread Water?

Next to the revenue assumption, the next most critical conjecture is the gross profit level.

If the budget gross profit percentage is higher than what you have achieved currently, you may be swimming in deep water without a life jacket.

Challenge any justification of why margins will improve: Without a specific and detailed plan to improve margins, it is unlikely they will.

Remember, it is a fool’s errand to do the same things and expect different results.

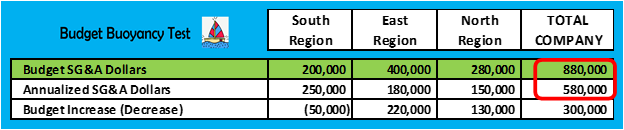

- Will the Fixed Cost Assumptions Weigh You Down?

Fixed costs are expenses that must be paid monthly, regardless of the level of revenue generated.

If your revenue projections fall short and/or your gross profit percentages fail to materialize at budget levels, you still have to pay the fixed costs in cash. This is the danger that could drown your company.

Without cutting costs (usually people), your current fixed cost level will be as much or more in the future.

Make sure that future actual revenue and actual gross profit percentages achieved can be less than budgeted but will still be sufficient to cover your current fixed costs. This is called a “safety margin.”

Every budget must have a built-in safety margin, or you are betting the ranch that you’ll achieve revenues and margins that have thus far eluded you. That’s a sucker bet.

A Final Warning to Owners

Just when you think you’ve done a commendable job of reviewing your budget, watch for insidious leaks that can still sink it.

In family and/or closely held companies, there is a built-in bias against telling those in power that the boat is sinking.

Call it “don’t-kill-the-messenger syndrome.” No one in finance wants to point out that the owner or operations folks are building budgets with unrealistic assumptions.

Owners need unvarnished truth regarding budget assumptions.

To eliminate in-house bias, have a trusted colleague or your CPA review the critical budget assumptions for reasonableness. You’re not asking for a detailed analysis; you just want a “sniff test” to ensure that major budget assumptions aren’t totally overreaching.

By asking a few strategic questions, owners can judge the sea worthiness of their proposed budget.

For your organization to thrive, you must be committed to utilizing a valid measuring stick: the budget. Like any other tool, however, it must be used correctly to yield the desired outcome.

Good luck on drafting a budget that serves you well!

By Eric Morris, CFO at Wayne Automatic Fire Sprinklers, Inc.

This article first appeared on the NSCA blog and has been republished with their express permission.

Read the original story here – Does Your Budget Hold Water? 4 Questions to Ask