During my decades-long career as a CFO, I’ve had the great pleasure of knowing and interacting with many superbly talented entrepreneurs.

Unfortunately, some of these remarkable individuals are also what I call “cash-blind owners.”

This “disorder” describes otherwise-savvy business owners who are totally oblivious to the monthly cash activity of their business.

Because many owners in the construction trades evolve from being tradesmen, this disorder occurs with a greater frequency within our industry.

Individuals suffering from this disorder typically hound their CFOs for monthly income statements and spend lots of time judiciously dissecting every morsel of revenue and expense information. At the same time, they never demand or review monthly cash-flow information.

Many owners believe that, if profits are solid, then the company is solid. They are greatly dismayed when they uncover the truth.

Do you know whether you’re a cash-blind owner?

Answer these three simple questions:

-

What is your company’s days sales outstanding (DSO)?

-

Do you watch your company’s sources & uses (S&U) of cash?

-

What is your monthly overhead cash burn rate?

I often hear responses like: “I’ll have to get back to you” or “I’m sure my numbers guy has a handle on this cash stuff.”

Maybe the “numbers guy” does know these numbers, but owners should personally have a handle on these three concepts, too. Many more companies go out of business due to poor cash flow as opposed to lack of profits.

Let’s examine these three concepts in more detail.

Days Sales Outstanding (DSO)

Why is DSO such an important concept?

In most construction companies, the largest asset is accounts receivable (AR). This asset has the potential to expand rapidly during boom times. Without proper oversight, open AR can rapidly suck the cash out of a company.

What exactly, then, is the DSO calculation?

DSO is a simple measure of how long it takes a company to collect cash on an account after invoicing. It is a basic but powerful concept. The calculation is as follows:

Your average AR balance is the opening AR balance plus the closing AR balance divided by two. The average daily sales is dollars invoiced during the period divided by the number of days in the period.

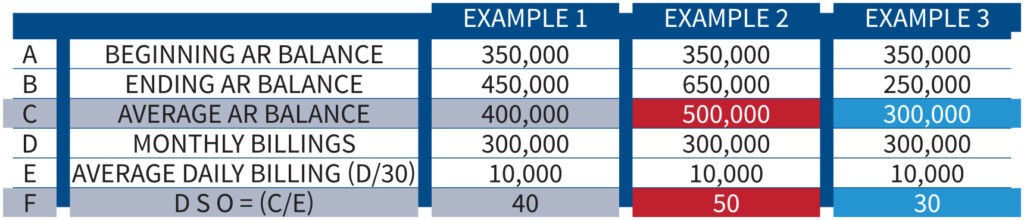

The DSO calculation works as follows. If your August opening AR balance is $350,000 and closing balance is $450,000, then your average AR balance is $400,000.

If you invoiced $300,000 in August, then your average daily sales are $10,000. (The ratio uses a 30-day month and 360-day year). Your DSO is 40 days ($400,000/$10,000). This means that, on average, it takes 40 days to collect your money after you invoice your customer.

When your average daily sales are $10,000 per day:

By lowering your DSO by 10 days, you release $100,000 into your operation

If you let your DSO grow by 10 days, you drain $100,000 out of your operation

10 Days of DSO = $100,000 in Cash!

A prudent business owner should demand to see DSO values each month – along with timely P&L statements each month.

Unfortunately, it’s typical to see the DSO value balloon when times are great and sales are booming. People are so elated by increased sales and profits that they tend to overlook how much cash is being actually being consumed – which is one of the symptoms of becoming cash blind.

Expanding sales always requires a cash infusion, but expanding sales and simultaneously slowing down collections can be disastrous. Watching monthly DSO values alerts owners to a pending cash crunch before it becomes devastating.

Even if you rigorously watch monthly days sales outstanding values, you can still suffer from other symptoms of cash blindness. If you’re an owner, do you know whether you spent more cash last month than you collected from your customers?

Stay tuned for Are You a Cash Blind Owner – Part 2, where we’ll discuss watching your company’s sources & uses (S&U) of cash

by Eric Morris, CFO at Wayne Automatic Fire Sprinklers, Inc.

This article comes from our partners at NSCA. Read the original story here: Are You a Cash Blind Owner? Part 1: Days Sales Outstanding

Handpicked Related Content

-

In the 20 years that Solutions360 has been working with low voltage contractors, almost all of them express the same goal to achieve predictable, steady, profitable growth. So, if this is the universal goal for low voltage contractors then why…

-

What makes a financially successful integration business? One with high profits? One with a solid financial plan? Many owners believe that, if profits are solid, then the company is solid. As we revealed in Part 1 of our blog series, Don’t…